Wish to add this to your own website?

Cost to Retail (Selling Price) Calculator

Answer:

Summary of Values

Summary of Values

Example Invoice for Buyer:

Calculator Inputs

Profit

Gross Profit; The amount of money earned after Cost has been paid. Profit = Selling Price - Total Cost

Gross Profit = Revenue - Cost. Revenue is amount received from the buyer less the Taxes.

Gross Profit = Revenue - Cost. Revenue is amount received from the buyer less the Taxes.

Margin

Gross Profit Margin; A percentage expressed as a ratio of gross profit to the revenue. Margin= (Profit / Selling Price) ×100

Gross Profit Margin = Gross Profit / Revenue.

Markup

The markup should be calculated based on cost. The formula is:Gross Profit Margin = Gross Profit / Revenue.

Markup = (Selling Price/Total Cost -1)×100

Given a 100% markup, the Selling Price should be double the Total Cost. Cost * (1 + Markup) = Selling Price

and therefore, Markup = (Selling Price / Cost) - 1 Cost Expense incurred to produce and distribute the item.

Total Cost = Item Cost + Shipping Cost + Selling Cost + Transaction Cost.

Item Cost

The Cost to acquire the item and might also include variable costs such as your additional production time and packaging rolled into it. For an Etsy craft product the Item Cost would also include your cost of materials and labor.

Shipping Cost

The amount the seller has to pay for shipping the product to the buyer.

Shipping Charge

The amount the seller charges the buyer for shipping. If you offer free or discounted shipping enter $0 or the discounted amount and the net shipping cost, if any, will be calculated into the Selling Price.

Sales Tax

Percentage charged on Item Price. Can also be charged on shipping.

Charge Sales Tax on Shipping?

Whether or not sales tax is charged on shipping varies from state to state. Check the policies of your marketplace provider regarding how they apply sales tax.

Selling Fees

This includes the fee of 5%, 10%, 15% or more that the marketplace (Amazon, eBay, Etsy, etc.) charges you once your item is sold. This fee is a percentage charged on Item Price and Shipping. Additional fixed costs such as an insurance or listing fee per item are also applied here. Etsy calls this fee the transaction fee. If you pay additional selling fees you can add them to these amounts.

Transaction Fees

Transaction or Payment Processing fees are the percentage (usually 2.2% to 3%) charged on the total transaction including Item Price, Shipping and Tax for processing a credit card payment. Additional per transaction payment processing fixed fees can include charges such as the $0.30 fee charged by PayPal or $0.25 charged by Etsy.

Selling Price

The calculator answer is the item price you should list for your item in order to meet your target return. You can set your target return to a Profit amount, a Margin percent or a Markup percent.Copyright © 1996-2025, The Laughing Professor, All Rights Reserved

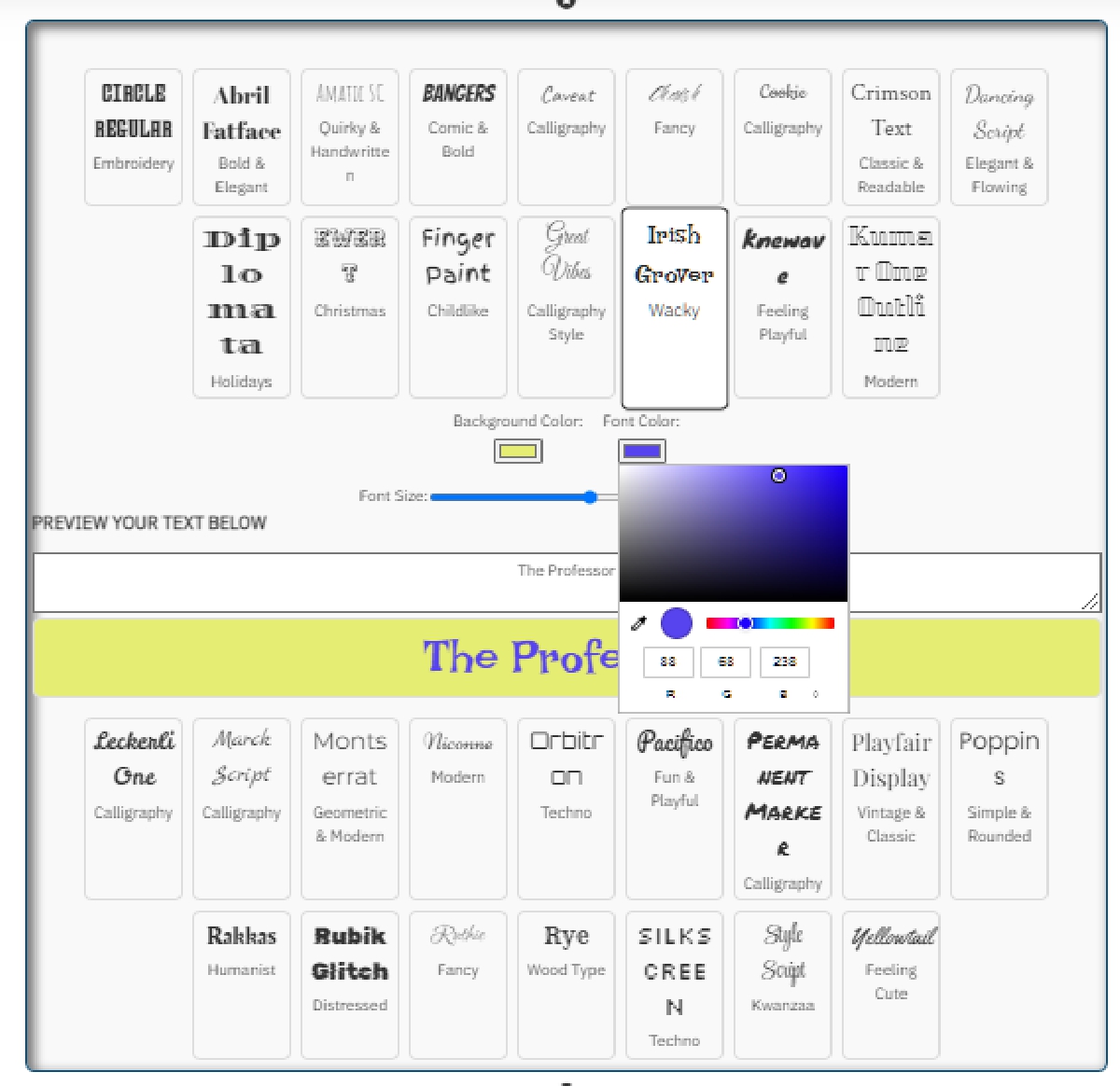

30 years of #TheProfessor

30 years of #TheProfessor

12% rewards for affiliate members

12% rewards for affiliate members