Understanding Trust Funds: Types,

Costs, and Legal Protections

Learn about trust fund types, costs, and legal protections. Discover how to set

up trust funds to safeguard finances, inheritance, and minimize tax

liabilities.

#1 Trust Funds: A Comprehensive Guide for Financial and Legal Protection

Trust funds are powerful financial

tools that provide long-term financial security and legal protection for

personal assets. They’re often used for estate planning, minimizing tax

liabilities, or protecting assets from creditors. Let’s explore the various

types of trust funds, how they work, and why they are beneficial for both

inheritance and personal liabilities.

Types

of Trust Funds:

- Revocable Trust:

This allows the grantor to modify or revoke the trust during their

lifetime. It’s ideal for estate planning, providing control and flexibility

over assets while avoiding probate.

- Irrevocable Trust:

Once established, this trust cannot be altered. It’s best for tax savings

and asset protection from lawsuits or creditors.

- Testamentary Trust:

Created through a will, this trust becomes active after the grantor’s

death and is typically used to manage inheritance for minors.

- Asset Protection Trust: Specifically designed to shield assets from creditors

and legal judgments, often used in combination with estate planning for

high-net-worth individuals.

Costs

of Setting Up Trust Funds:

The costs for setting up a trust

fund vary depending on complexity and legal requirements. On average,

establishing a simple trust can range from $1,500 to $5,000. Irrevocable

trusts and asset protection trusts often require more complex arrangements,

costing between $5,000 to $10,000 or more.

How

to Get a Trust Fund:

- Consult with an Estate Attorney: An attorney with expertise in trust law will draft

the trust documents and ensure that they comply with state and federal laws.

- Financial Advisors:

Working with a financial advisor can help you understand which trust type

is most beneficial for your financial goals.

- Naming Trusts for Better Credit and Grant Options: When naming your trust, consider using keywords like

“Family Trust” or “Charitable Trust” to optimize for grant eligibility or

financial benefits. For instance, charitable trusts might offer specific

tax deductions or grant opportunities.

#2 LLC Formation: Costs, Benefits, and How to Start

Learn how to form an LLC, the associated costs, and the benefits of an LLC structure for small business owners. Discover state-specific fees and how to register.Everything You Need to Know About

Forming an LLC

A Limited Liability Company (LLC) is

a popular choice for small business owners seeking personal liability

protection while maintaining a flexible business structure. LLCs offer tax

advantages and legal protections that are essential for business growth. Here’s

a detailed guide on LLC options, the costs involved, and how to set one up.

Benefits

of an LLC:

- Limited Liability:

Protects your personal assets from business debts and legal claims.

- Tax Flexibility:

LLCs allow for pass-through taxation, meaning the business's income is

only taxed once at the owner's level, avoiding corporate taxes.

- Easy Management:

Unlike corporations, LLCs have minimal formalities, making them simpler to

manage.

LLC

Costs by State:

The cost of forming an LLC varies by

state, with fees ranging between $50 to $500. Some states, like Wyoming

or Delaware, are popular for their business-friendly tax regulations and lower

filing fees. However, most LLC owners will choose to form their LLC in the

state where they operate their business.

How

to Create an LLC:

- Choose a Name:

The name must be unique and include “LLC” or “Limited Liability Company”

in the title.

- File Articles of Organization: Submit the necessary paperwork to your state’s

business filing office, often the Secretary of State.

- Pay the Filing Fee:

Depending on your state, you’ll need to pay the filing fee, which can

range from $50 to $500.

- Create an Operating Agreement: Although not required in every state, this document

outlines the LLC’s management structure and operating procedures.

- Obtain an EIN:

Get an Employer Identification Number (EIN) from the IRS for tax purposes.

Applying for Taxes and Grants: A

Guide for Small Businesses

Find out how to apply for small business grants, manage taxes, and discover the

best resources for financial assistance. Learn how to access federal and state

programs.

#3 Taxes and Grants: What Small Business Owners Need to

Know

Navigating the complexities of taxes

and finding available grants are critical to the financial success of any small

business. Grants offer funding without repayment, while tax strategies help

reduce the financial burden. Here's a comprehensive guide on how to apply for

both.

How

to Apply for Business Grants:

- Research Available Grants: Start by exploring federal options like SBA (Small

Business Administration) grants, or state and local programs aimed at

supporting small businesses.

- Eligibility Criteria:

Each grant will have specific criteria, including the type of business,

location, and sometimes industry focus.

- Prepare a Business Plan: A solid business plan increases your chances of

receiving a grant. It should detail your business objectives, financial projections,

and how the grant will be used.

- Submit Applications:

Each grant program will have an application process, often requiring

financial documents and statements. Make sure to apply well before the

deadline.

- Who Can Help:

Organizations like SCORE, the SBA, or local business

development centers provide guidance and assistance in applying for

grants.

Managing

Small Business Taxes:

- Track Expenses and Income: Maintaining accurate financial records is essential

for preparing your tax return and ensuring you maximize your deductions.

- Work with an Accountant: Tax regulations change frequently, and a professional

accountant can help you stay compliant while minimizing your tax burden.

- Apply for Tax Credits:

There are numerous small business tax credits available, including the Work

Opportunity Tax Credit (WOTC) and Energy-Efficient Business Credits.

- Federal vs. State Taxes: Depending on your state, you may be subject to both

state income tax and federal tax on your business earnings.

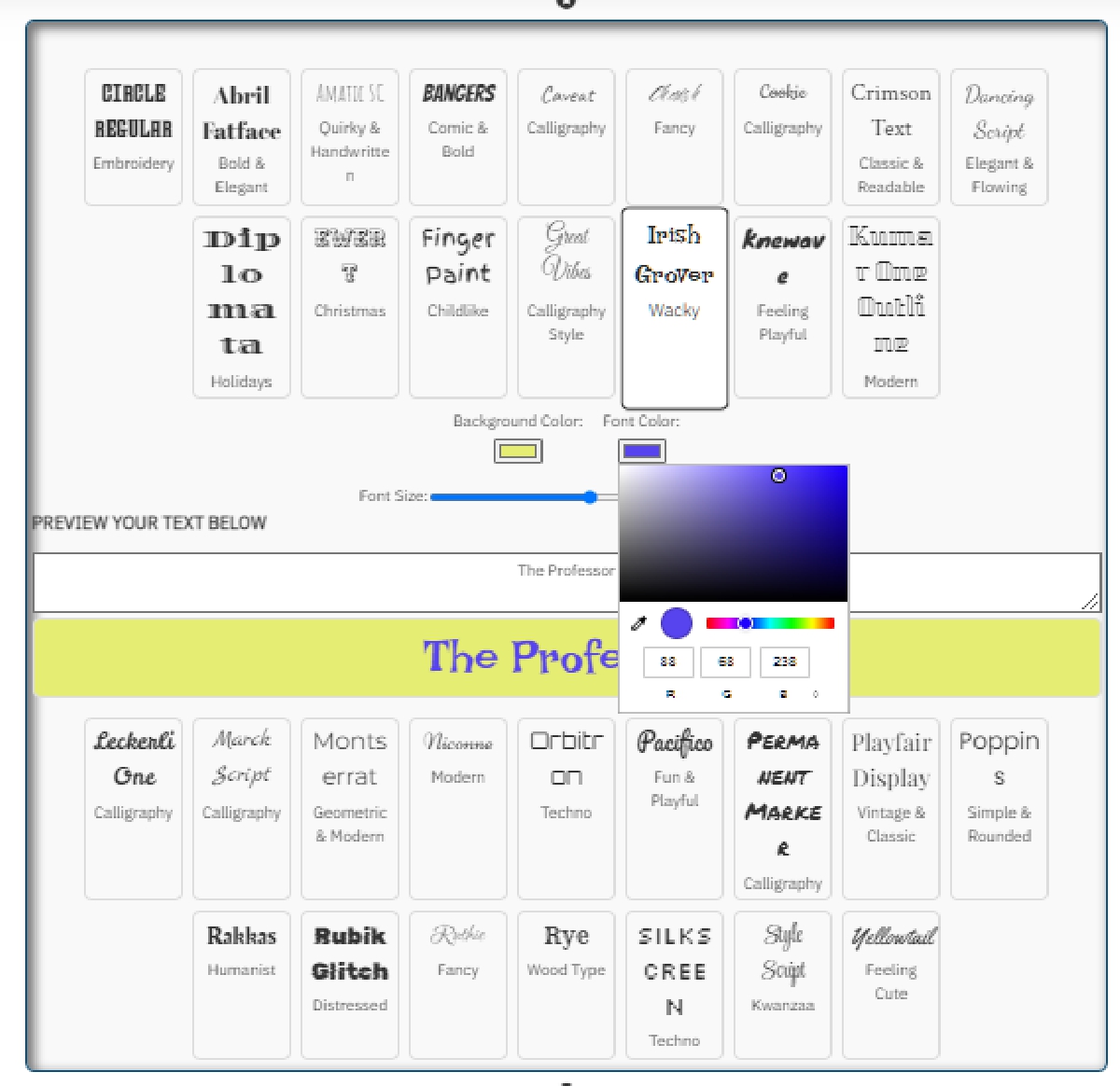

30 years of #TheProfessor

30 years of #TheProfessor

12% rewards for affiliate members

12% rewards for affiliate members

Leave a Comment